- Tawnya Hallman

- 0 Comments

The Smart Way to Save for a Down Payment

There are plenty of savings and investment accounts you can use to save for a down payment on a home. Depending on the timeline, you could consider using a...

There are plenty of savings and investment accounts you can use to save for a down payment on a home. Depending on the timeline, you could consider using a...

The First Home Savings Account or FHSA is a tax advantaged account introduced by the federal government in April 2023. It’s one of the best accounts a qualifying person...

Using a tax rebate for retirement savings is ideal because it doesn’t affect today’s cash flow. Here are 6 things you could consider doing with a tax rebate in...

An estate plan makes sure one's family is financially secure; it makes handling an estate easier (a thankless and arduous task for executors) and keeps more money in the pockets of...

Best Money Decision: HISA One of the BEST things my husband and I ever did to make a huge and positive impact on our financial life was to open...

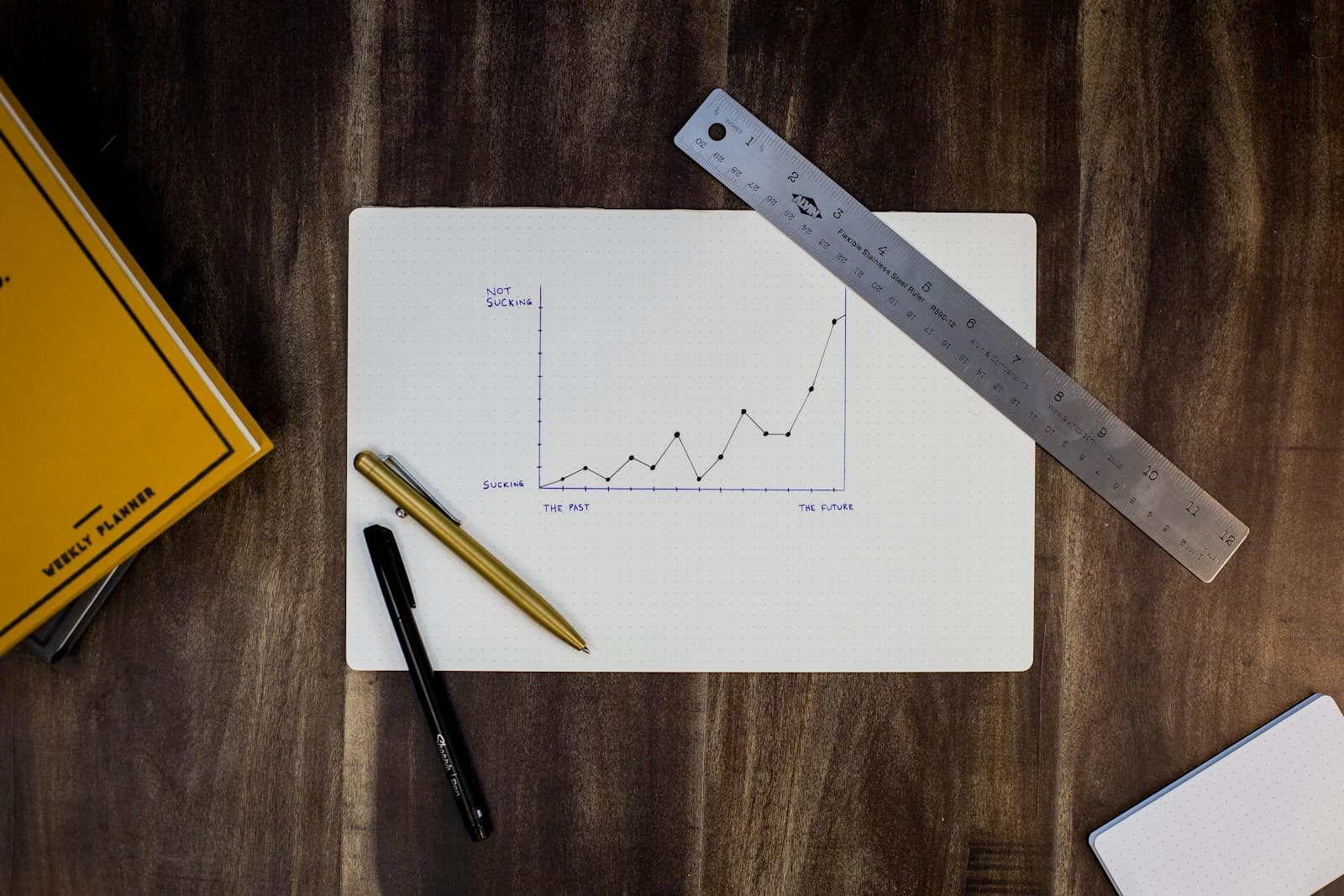

About 6 months ago we started using new financial planning software called Planworth. Since then, we’ve created about a dozen financial plans for clients. Some clients are retired, some...

The TFSA is one of the most misunderstood accounts amongst Canadians. That’s a shame because it has so much potential to add a financial cushion to retirement. This article...

Saving For a Goal Saving for a specific goal like a downpayment for a home, a vehicle or a vacation needs a plan and the right place to save...

The RESP is one of the best ways for Canadians to save for a child’s education mainly because of the Canada Education Savings Grant, the Canada Learning Bond and...